- #Credit score ranges by age how to#

- #Credit score ranges by age professional#

- #Credit score ranges by age free#

Startup Business Credit Cards with No Credit.

#Credit score ranges by age free#

#Credit score ranges by age how to#

How to Build Business Credit Without Using Personal Credit.How to Build Credit without a Credit Card.Please do the appropriate research before participating in any third party offers. We do our best to maintain current information, but due to the rapidly changing environment, some information may have changed since it was published. Any references to third party products, rates, or websites are subject to change without notice. This may include receiving payments,access to free products and services for product and service reviews and giveaways. In accordance with FTC guidelines, we state that we have a financial relationship with some of the companies mentioned in this website.

Wealth Pilgrim and Wealth Resources Group are affiliated companies. Neal may provide advisory services through Wealth Resources Group, a registered investment adviser. Wealth Pilgrim does not provide investment advisory services and is not a registered investment adviser.

#Credit score ranges by age professional#

Please contact an independent financial professional for advice regarding your specific situation. The information contained in is for general information or entertainment purposes only and does not constitute professional financial advice. Wealth Pilgrim receives compensation from Google for advertising space on this website, but does not control the advertising selection or content. Wealth Pilgrim is not responsible for and does not endorse any advertising, products or resource available from advertisements on this website.

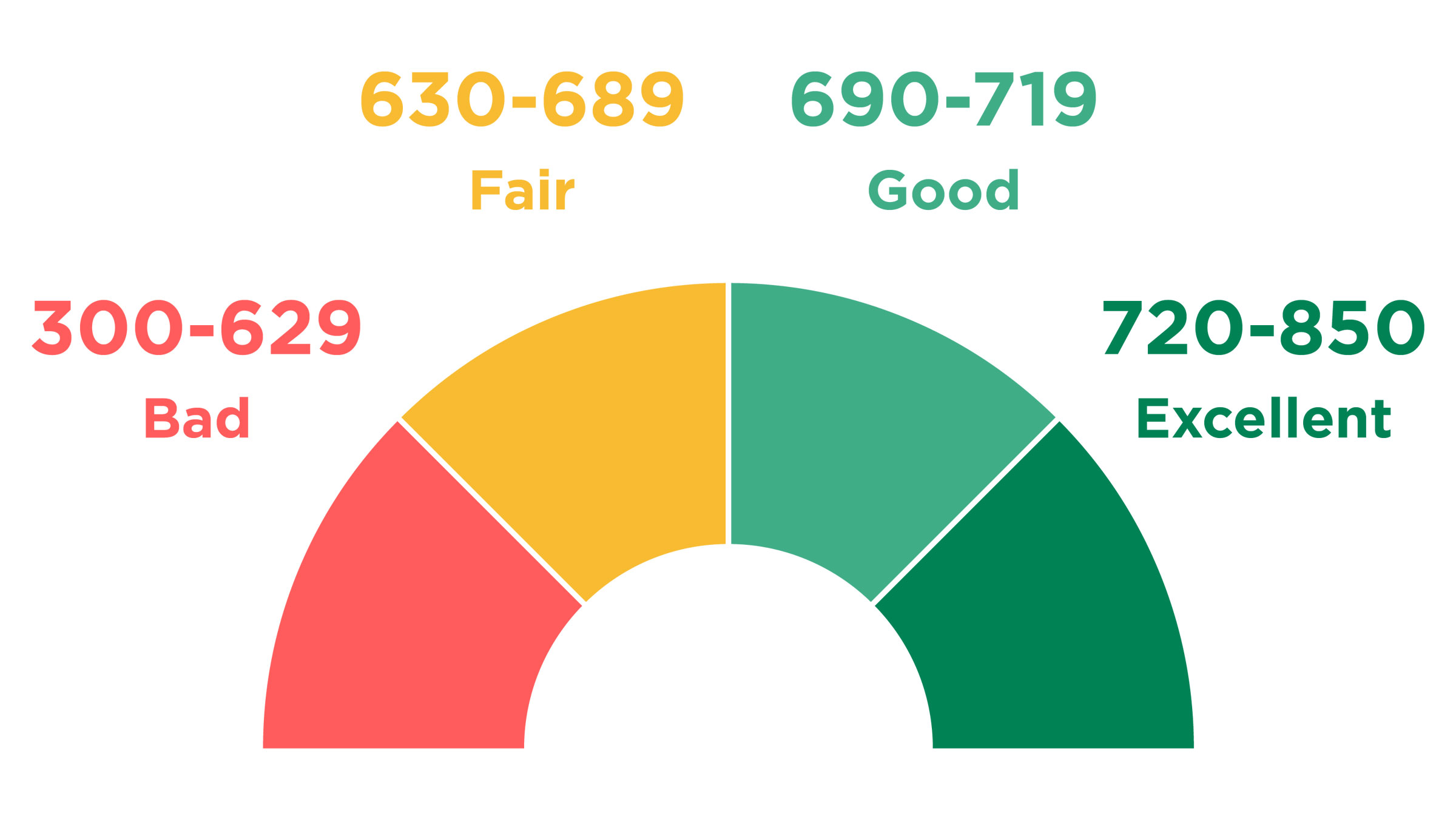

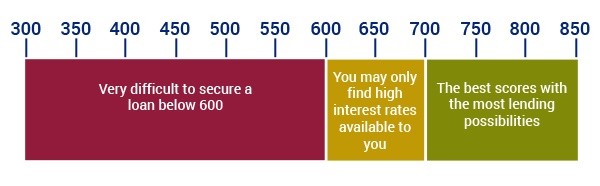

Interested in finding out what your score is? You can get your free credit score here: That’s how the lenders use your FICO credit score and that’s why you must do everything you can to improve your credit score fast. Obviously, the higher your score, the lower the risk…and that means you’ll get better interest rates when you get credit. If your score is above 799, you have only a 1% chance. This means if your score is below 500, you have an 87% chance of being late in your payments by 90 days or more over the next two years. PERCENTILE (%) OF PEOPLE SCORING AT THE DELINQUENCY RATE The FICO score estimates the probability that you’ll be late in a payment for 90 days or longer over the next two years. If he or she has a credit problem, you need to know about it before it sinks your score and the relationship. Neal’s Note: Make sure to check your spouse. That means if you want great credit terms, shoot for a rate that’s higher than 723. Fair Isaac says the Median FICO Score in the US is 723. It’s more about how safe the bank feels their investment in you is at this time. Your credit score isn’t so much about you. These and other factors come into play in determining what rate you’ll pay for credit.

0 kommentar(er)

0 kommentar(er)